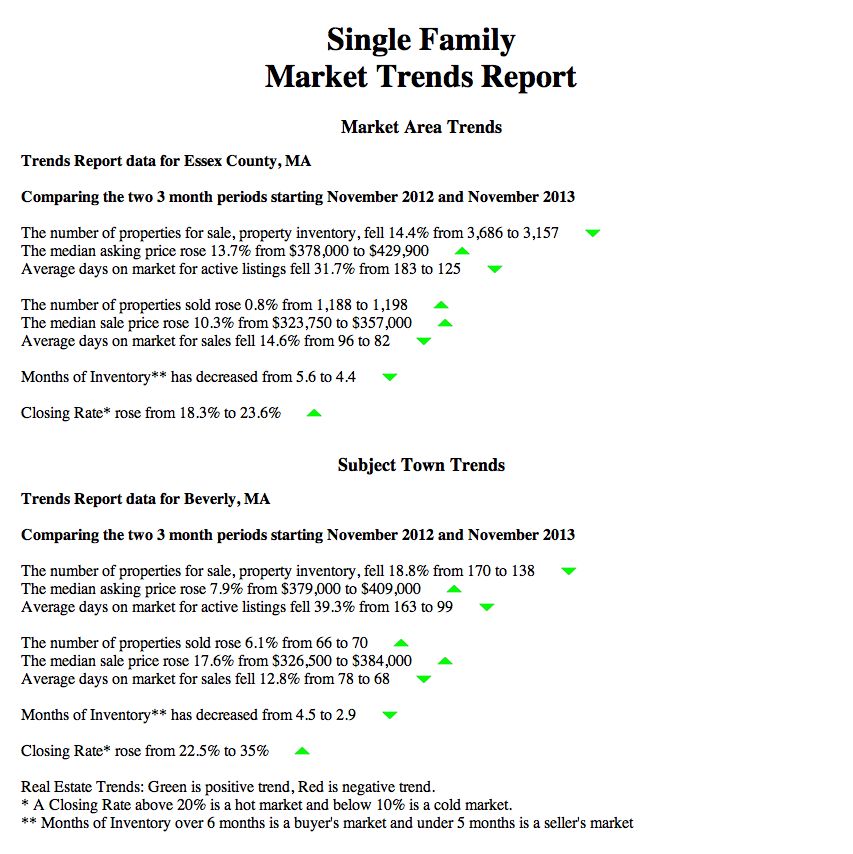

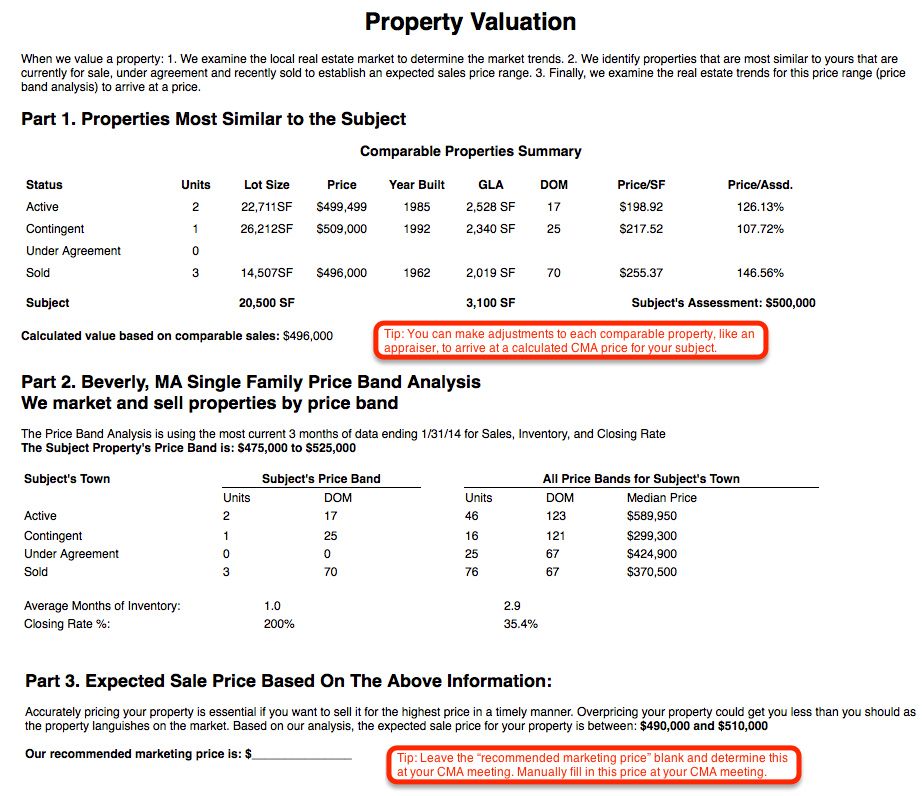

Our enhanced CMA software now auto-calculates the local Market Trends and generates a Property Valuation Report.

Sample Reports:

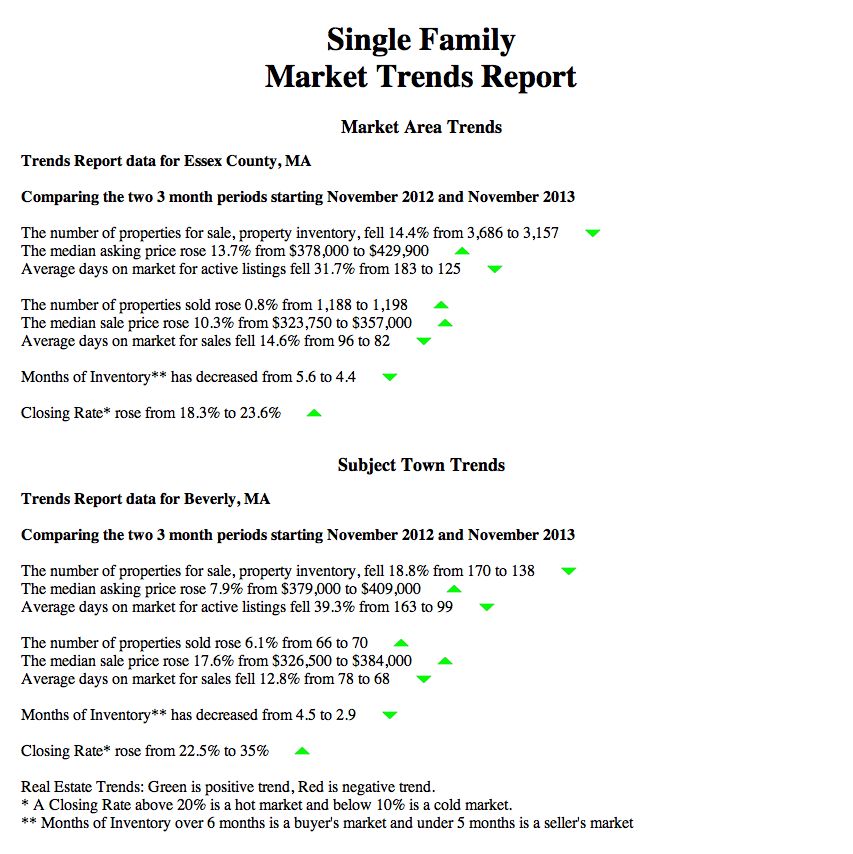

The Market Trends Report uses arrows to indicate the direction of the data and the color of the arrows indicate the direction of the trend: Green indicates a Positive Trend, Red indicates a Negative Trend and Black indicates the Trend is Unchanged.

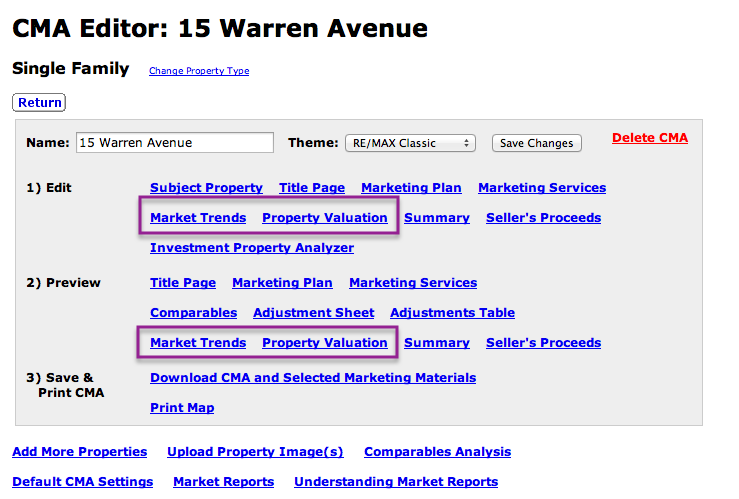

How to Set Up the New Reports:

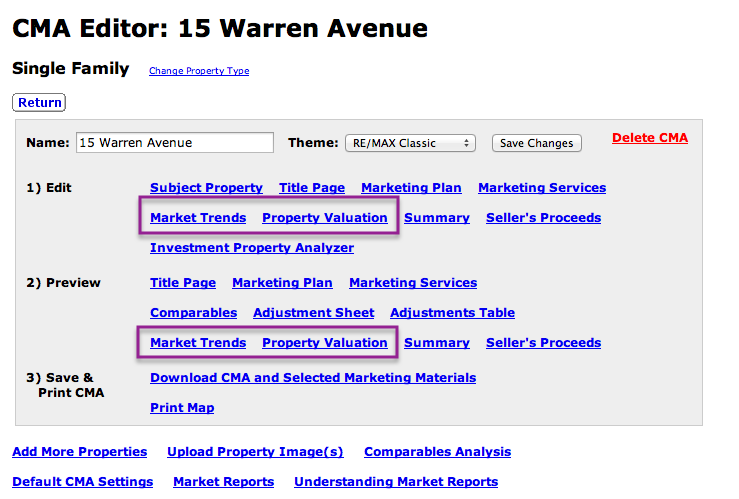

The new reports are accessed from the CMA Editor screen for each of your CMAs.

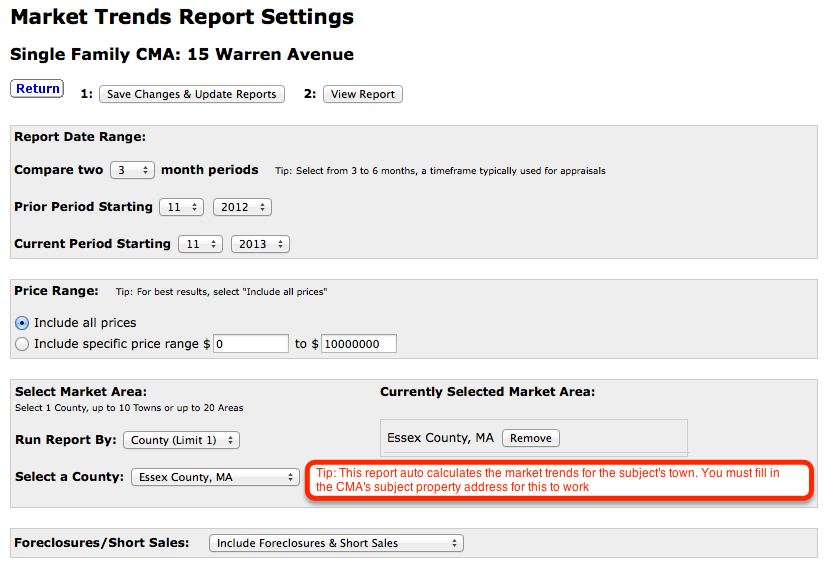

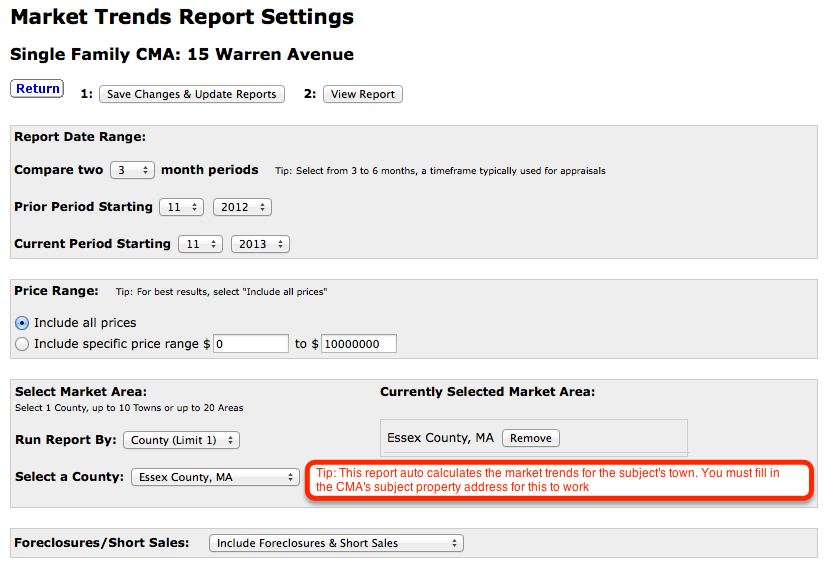

How To Setup A Market Trends Report:

1. Click Edit > "Market Trends" button on the CMA Editor page to view the Market Trends Report Settings page.

2. Select two comparative periods. The default setting compares the most recent 3 month to the same year earlier period.

3. Select your market area which can be: 1 county or 10 towns or 20 areas of towns.

4. After you have selected your market area, click the "Save Changes and Update Reports" button.

5. When the Market Trends Report has been generated, click the "View Report" button.

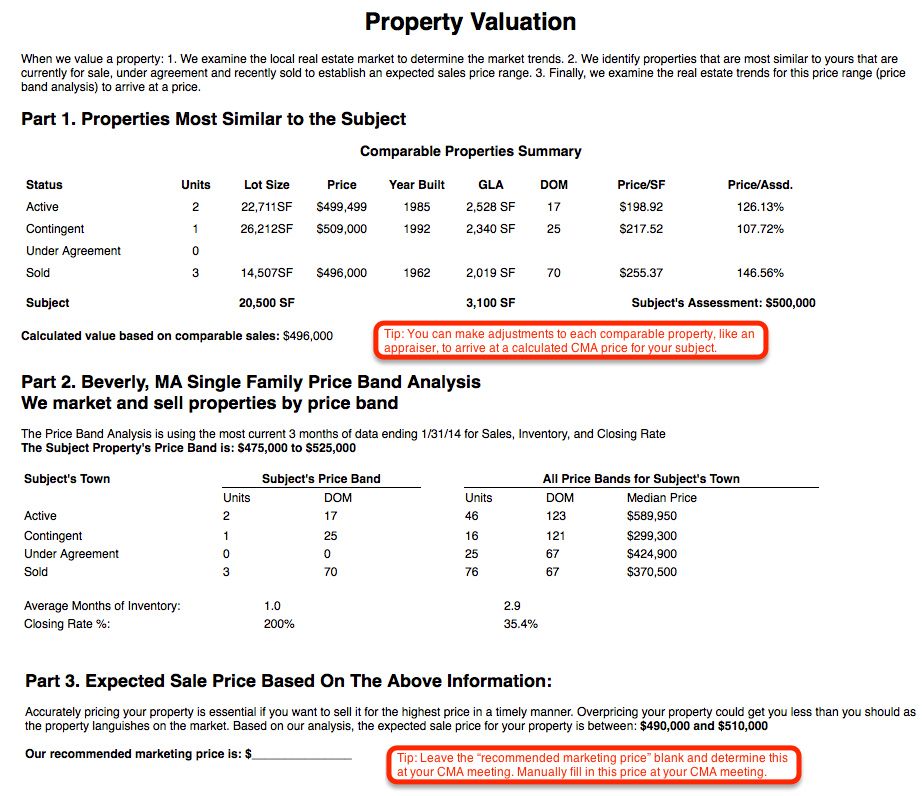

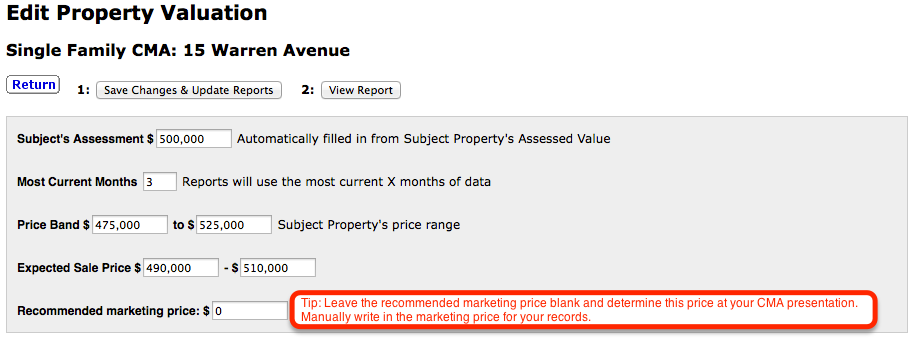

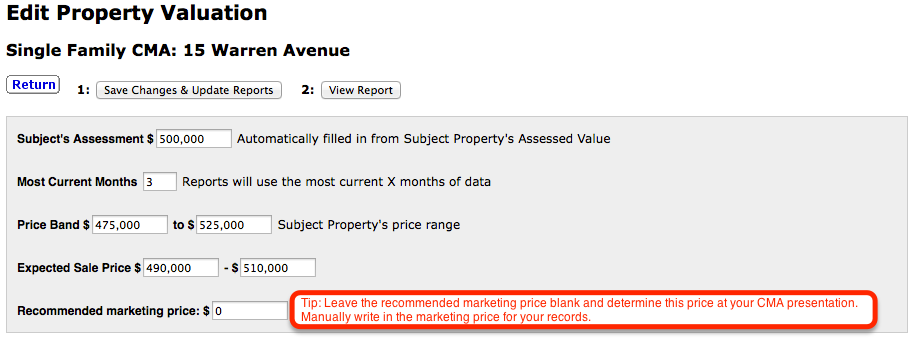

How To Setup A Property Valuation Report:

1. Click Edit > "Property Valuation" button on the CMA Editor page to view the Property Valuation Report Settings page.

2. Fill in the Property Valuation settings page. The settings default to using the most recent 3 months of data, but you are able to customize this.

3. Click the "Save Changes and Update Reports" button. When it finishes processing, click the "View Report" button.

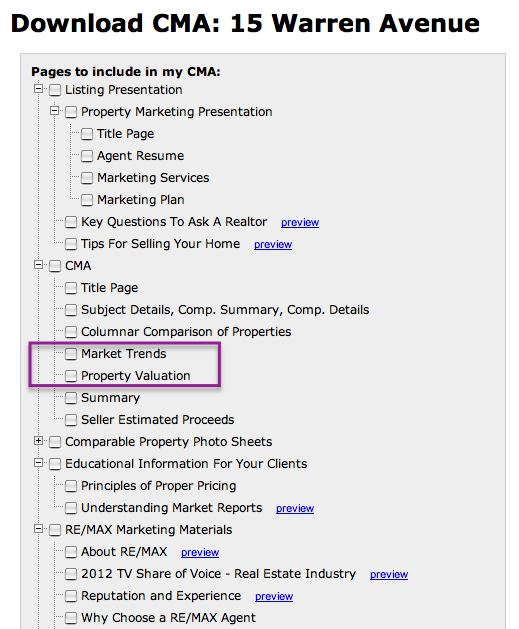

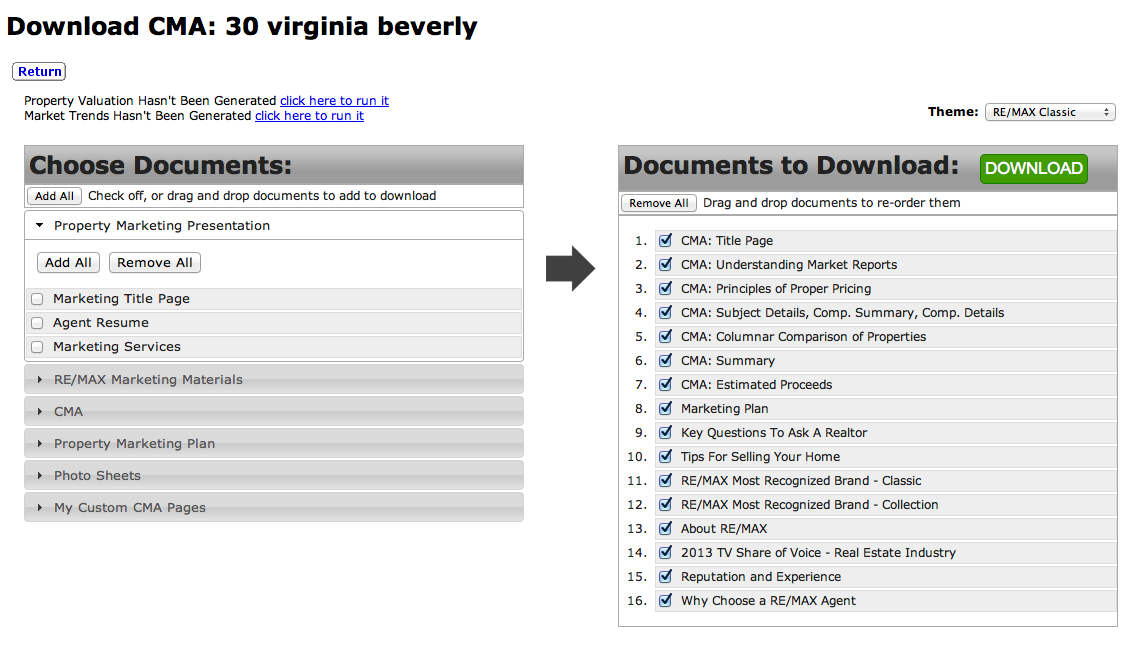

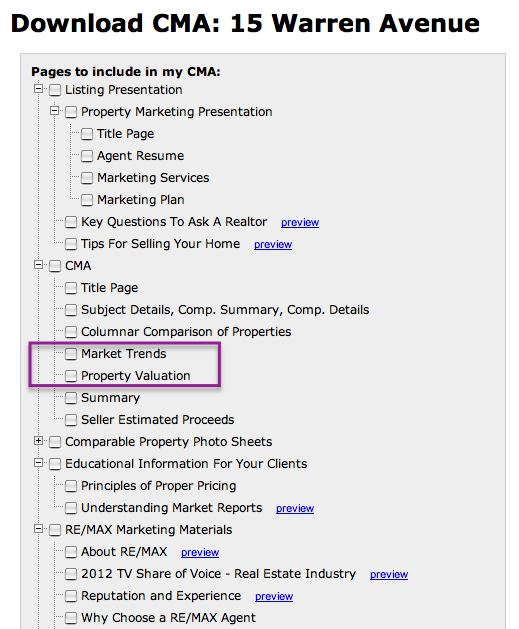

How To Include These New Reports In A CMA

Both the Market Trends Report and Property Valuation Report can be included in your downloaded CMA.

1. Click the "Download CMA and Selected Marketing Materials" button on the CMA Editor page

2. Select the Market Trends and Property Valuation selection boxes

3. Click the "Click here to build your CMA" button at the bottom of the Download CMA page

The KCM Blog recently posted a very interesting metaphor on prospecting from, get this, the animal kingdom. Well, sort of the animal kingdom. It wasn't exactly the Sahara desert, but rather a group of ducks in search of table scraps at a hotel restaurant in California.

The KCM Blog recently posted a very interesting metaphor on prospecting from, get this, the animal kingdom. Well, sort of the animal kingdom. It wasn't exactly the Sahara desert, but rather a group of ducks in search of table scraps at a hotel restaurant in California.